22.06.2021

31 min listen

With Mark Williams-Cook

Season 1 Episode 116

Episode 116: Shopping Graph, more June Core news, FAQ schema and Search Console Insights

In this episode, you will hear Mark Williams-Cook talking about context to Google's plans around Google Shopping Graph, a quantitative analysis and thoughts from Lily Ray about the June Core Update, Google reducing visible FAQs in SERPs and whether the new Google Search Console reports are good or bad.

Play this episode

01

What's in this episode?

In this episode, you will hear Mark Williams-Cook talking about:

Shopping Graph: Introduction and context to Google's plans around Google Shopping Graph.

June Core Update: Quantitative analysis and thoughts from Lily Ray

FAQ schema: Google reducing visible FAQs in SERPs

Search Console Insights: New Google Search Console reports - good or bad?

02

Links for this episode

Danny Sullivan tweet

/dannysullivan/status/1405914145635983365

Search Console insights blog

/search/blog/2021/06/search-console-insights

Lily Ray's blog post about winners and losers of the June 2021 core update

/insights/seo/winners-and-losers-of-googles-june-2021-core-update/

03

Transcript

MC: Welcome to episode 116 of the Search with Candour podcast recorded on Saturday, the 19th of June 2021. My name is Mark Williams-Cook; loads to talk to you about today. We're going to be looking at the new Search Console Insights that are now available as part of Google Search Console, how Google's taken a machete to the FAQs in their search results. The Google Shopping Graph announced at Google I/O if you haven't caught that yet. We'll be talking a little bit more about the June core update winners and losers that we've been seeing.

Before we kick-off, I'd like to say this podcast is very kindly sponsored by our friends at Sitebulb. If you haven't heard of it, Sitebulb is a desktop-based Windows and Mac SEO auditing tool. I've used it for several years now, pretty much as long as it's been out. We use it at the agency as well. It's an absolutely fantastic piece of software. I use it on pretty much every client I have contact with. Every week I talk about something special that Sitebulb does or features that's helped me out. This isn't cheating because I've talked about this before, which is that you can actually schedule audits on Sitebulb.

One thing that I didn't actually know because I hadn't had to do it before, was I was doing a project last weekend where I was looking at about a dozen sites in a group that were doing a migration. I needed to run audits of all of those sites. It was getting late in the day. I needed to run Javascript audits as well. These audits were going to take a while. Something I didn't actually realise Sitebulb can do, apart from just scheduling them, it will actually just cue the audits as well. I actually just put the first site in, and, one, it was running. I put the second, third, fourth... There were 13 sites in. It just very, very easily queued it for me, which was brilliant because then I just went out and did what I was going to do, actually went to bed, woke up the next day, and all the audits were there for me.

It's those kinds of small details that make Sitebulb really nice to work with. They've got a special offer for Search with Candour listeners. Apart from the usual free trial, you get an extended trial. You get 60 days for free at Sitebulb.com, and then you go to /SWC - sitebulb.com/swc. It's a trial that requires no payment, no credit card, anything like that. It's no obligation. Just try it. Download it. I'm sure you'll love it. Give it a go.

Google has been removing FAQs from SERPs. Well, not all of them, but it has slashed the amount of frequently asked questions that are appearing directly in the search result pages. For those of you that don't know, FAQ page schema has been away now for quite a while. But SEOs and Webmasters have been able to mark up the questions and answers on their page so that they show directly in the search result when a user does a search. Of course, this takes up more real estate pushing your competitors down. This is actually likely the reason that Google has decided to take action, in that SEOs have just been pushing this too hard, turning it up to 11.

On Thursday, the 17th, Mark Barrera, an SEO at TrustRadius, tweeted, "Looks like Google is restricting FAQs to only show two and no ability to see more. Both of these sites have more than two FAQs marked up. Seeing this change for all queries and sites." He's given a screenshot. He's referencing there in regard to coupons. There were a few people that joined in that debate. Some saying they could still see more than two, three, and four in some cases. There's a little speculation that it might have been a US-only change. But then, very helpfully, Danny Sullivan did come down from the palace and tell us that, yes, we made a change recently that limits these to two maximum, although he didn't go into why. This is helpful, maybe, so that you can know you haven't done anything wrong. You're very likely now to have seen any FAQ listings you have got or any new ones that you get to be limited to two questions only.

I personally thought they were actually quite helpful for users, the FAQ schema, and having the rich result in the SERP. I guess the bigger picture that I can't see, and, obviously, there is, we're only all working on our tiny, tiny little edge of the web, I guess there was a lot of spam that was going on that was tipping the scales in terms of Google, considering that the overall quality has been brought down by these. It'd be interesting to see if it does stay this way. But currently, two FAQs are your max.

We've got a new set of data to play with now within Google Search Console, and that is Search Console Insights, which is currently rolling out for everyone. This is coming out of beta. If you log into your Google Search Console, you'll likely now see a yellow bar at the top, which will offer you to go into Search Console Insights. So what is it? Google describes it as: "Search Console Insights is a new experience tailored for content creators and publishers, and can help them understand how audiences discover their site's content and what resonates with their audiences. This new experience is powered by data from both Google Search Console and Google Analytics." You need to actually have your Google Analytics hooked up to your search console to get the most out of this.

Interestingly, I was doing some reading about this beta. It doesn't actually support Google Analytics for GA4 at the moment, which I found interesting because Google obviously had been pushing that very hard. If you set up a new Google Analytics property, the default now is just Google Analytics 4. They are working on that. It will come, but it currently only supports Universal Analytics installations. So how can Search Console Insights help you? Search Console Insights can help site owners, content creators, and bloggers to better understand their content performance. For instance, it can help answer the following questions: what are your best-performing pieces of content? How are your new pieces of content performing? How do people discover your content across the web? What do people search for on Google before they visit your content, and which article refers users to your website and content?

If you are an SEO, and you've been working in digital marketing, you've used GA/GSC before, you've probably realised there isn't actually anything new you can discover. There's no new, obviously, data sources. This is just about how GSE is going to pre-can and slice that data for you.

While I think this is good... I think the target audience for this is actually maybe more lay users, as I said, content creators, so people who aren't specifically thinking about digital marketing. Maybe they're not, specifically, thinking about SEO. Like we've seen in Google Analytics, where you can just ask Analytics questions now and it gives you prompts with these insights in Analytics, we're seeing the same in GSC. This means you don't really need to know your way around quite so much just to pull out these basic facts about your content and basic pieces of information that might help you do more of a thing that's working.

Now, with my cynic hat on, which is permanently on pretty much, one thing that does concern me, because it's a trend we have seen across Google, is I fear this might be the first step in dumbing down this data. We have seen this happen. Well, certainly, we've covered it for years now in Google Ads, where we've had raw data slowly stripped back and replaced with more heavily processed data that tells you the insight already. You've got these two situations, which is, Google can give you raw data which you can take, you can process, you can manipulate it, and you can form your own insights from that data.

The other approach, which is probably more suitable for the majority of people but is a lot less helpful for people who may have careers in this, and it's their specialism, is that they prepackage the insights for you. You get less of the actual data. You don't get the actual data points. You're just getting prepackaged, "Here's the insight. Here's the result. Don't worry about the workings." Now, that's dangerous because those workings and the machinery that goes into getting that output is all part of what we need to understand to do marketing.

I am a little bit worried as to whether we're going to see, eventually, Search Console data be replaced with insights as we have already because we're on a still, I guess it's not new, but "new" version of Google Search Console. We moved from Webmaster tools to this version of Google Search Console, which is different. A lot of people, at that time, did complain that we lost a lot of the data and reports that were used to using Webmaster tools. We're over, I think, that grumbling stage now. They've met us halfway in some instances. But it wouldn't shock me terribly if, over the next few years, Google does transition. Once again, roll to this insights platform, and away from the data we're seeing in Google Search Console; can only hope that's not the case, but it is there now; might be helpful, as I said, for maybe people who aren't quite so much into doing that analysis. You should have access login, and you should see that yellow bar at the top. Go check it out.

We've had a little bit longer now since the June 2021 core updates rolled out. At the beginning of this week, I caught a really nice writeup, again, as usual by Lily Ray, who had some thoughts that she shared on the core update and results we've seen. I liked this write-up, particularly because it contrasts what we covered in terms of Mordy's thoughts. Mordy's thoughts, which we covered the other week, were quite qualitative in that he had looked for specific examples and deep-dived down into those and discussed what he thought might be the reasons to see such fluctuations. Whereas Lily has taken an approach I've seen her take before, which is a little bit more quantitative and looks at a larger set of data.

I'll read the methodology of her post here. She says, "Our analysis of winners and losers is done by collecting the SISTRIX visibility index score of a given root domain between the dates of the 4th of June 2021 and the 14th of June 2021. The score is intended to reflect how well a domain ranks across SISTRIX index of 1 million tracked keywords in the United States. It's Google.com. We then collect the category of each domain using similar web categories. This allows us to see whether changes related to the algorithm update are affecting certain categories or niches more than others. For this analysis, we collected the visibility index scores of 1,900 domains in 31 categories. We also filtered the domains to any domain with a visibility index score of over 0.25 on the 14th of June, as the domains below this amount had virtually no SEO visibility and the data is therefore not entirely reliable."

We've talked to, and we've cited SISTRIX data before. This is quite a nice approach of using a couple of third-party tools to get that data and categorise it. Of course, I will put a link to this post and all the other posts of announcements we mentioned on our show notes, which you can find at search.withcandour.co.uk.

Just before I go into Lily's analysis here, I am just going to read out her disclaimer to be fair to Lily because I know a lot of people can pick holes in these kinds of studies and approaches. The disclaimer is, "It's important to remember that thousands of factors are at play in the changes we see to website rankings during a core update rollout making it impossible to isolate exactly what happened or what specifically Google aimed to achieve. Furthermore, the June 2021 co-op date will be followed by another core update in July." Very good point. "Plus the page experience update will also be launched in the coming weeks." A very, very good point. "Therefore, the data displayed here may change drastically as a result of those updates. Google even confirmed that in some rare cases, sites may see a complete reversal in performance between the June and July core updates. However, it can be illuminating to look at the performance of websites and categories at scale, after a core update to see if any patterns exist among winning and losing websites."

With all of that in mind, I hope you can approach this level-headed because there were a few things here that really interested me. I'm not going to go through the whole post because there's quite a lot in there. There's a lot of tables and charts, which really you'd benefit from just looking at. They're quite interesting.

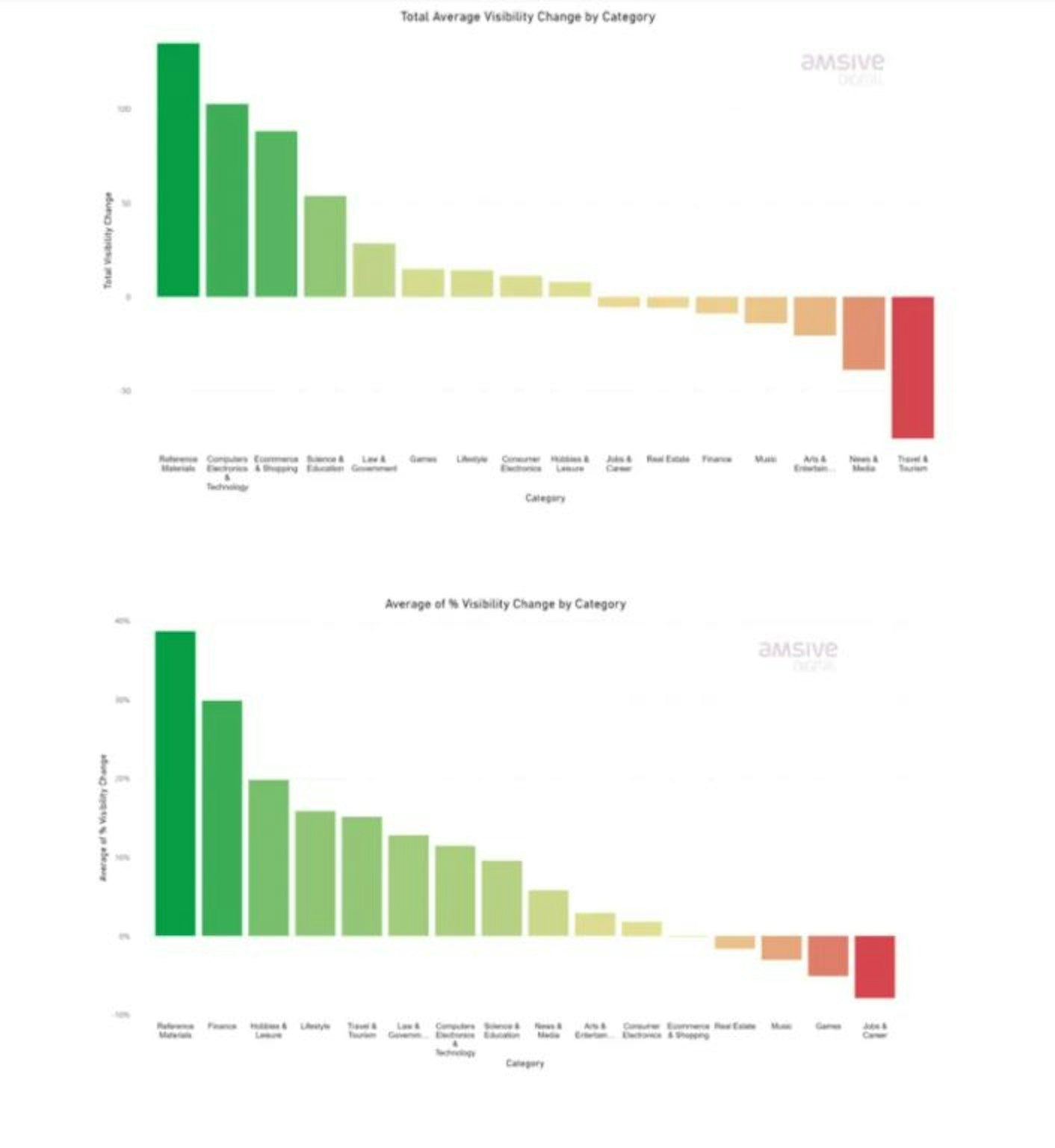

One thing that really stood out to me is that there is this very marked difference in visibility change by category. The way that Lily's presented this data as well is particularly interesting because it shows how important it is to be careful about how you present data. She's done two charts, which chart the total average visibility changed by category and the average percent visibility change by category.

There's definitely correlations there, in that, some have got the highest points change and percentage change, and others, such as the travel and tourism industry, have got right on the far red end of the total average visibility change by category. But actually, they're in the green on the average percentage visibility change. I will attempt to explain why, or rather, attempt to explain why Lily's saying this way.

The first and most obvious correlation that we can see here is with dictionaries and reference sites. Lily says, "One of the most salient patterns from this update so far is the drastic increase in visibility seen by dictionary sites, including Wikipedia, which has seemed to decline with prior recent core updates. There is a prominent change in dictionary sites that indicates that Google appears to be determining that many more queries should result in dictionaries to be shown in prominent positions."

There's an example of what these changes look like on a query level for the query correctional. The California Department of Corrections and Rehabilitation was replaced by dictionary.com for the number one ranking position, perhaps because Google determined that defining correctional is the main intent of most searches above looking up that correctional facility.

Obviously, my agency is called Candour. We managed to rank organically for the top in the UK just for the word Candour. But interestingly, Google still gives the dictionary definition of the word candour. I think it's because we have the phrase "duty of candor." It's not a very commonly used word. I always find it interesting that Google is assuming that most of the intent between people searching for a word that is our company name is people actually just want to know what the word means.

Related to this, Lily's also pointed out that it's worth noting that Google edited its search quality guidelines in October of 2020. One of the biggest changes included new language about dictionary sites and when a query should generate a dictionary result. It's very kindly brought up this change for us. It says... This is according to the Google search quality guidelines, "When assigning needs met ratings for dictionary and encyclopedia results..." When I say here, "When assigning needs met ratings," we are now talking about these Google quality guidelines for their search quality raters. These are the people who are essentially taking sites and queries and manually grading how well they match that query. This is something Google does not directly impact that algorithm, but checks how their algorithms are performing. Hopefully, that'll make more sense now if it didn't.

"When assigning needs met ratings for dictionary and encyclopedia results, careful attention must be paid to the user intent. Like all results, the helpfulness of dictionary and encyclopedia results depend on the query and user intent. Dictionary and encyclopedia results may be topically relevant for many searches, but often, these results are not helpful for common words that most people in your rating locale already understand. Reserve high needs met ratings for dictionary and encyclopedia results when the user intent for the query is likely 'What is it?' or 'What does it mean?' The result is helpful for users seeking that type of information."

I think that's a really good point that they've tweaked that reference dictionary wording in their quality-rated guidelines. Obviously, I think there was maybe a mismatch between what they were steering people to rate and what users actually wanted. Now, I mentioned between the two charts that Lily posted between the average visibility change and the percentage change. We saw this difference in the tourism category. This falls mainly on the neck of TripAdvisor, which lost a pretty eye-watering 75.59 visibility points since the update was launched, which is a lot.

Lily says, "Looking closely at keyword movement, it appears that TripAdvisor saw some declines for keywords, where an official travel destination website took its place, such as..." She's given a below example for the query whitewater rafting, where TripAdvisor was pushed from position three to page two, which... It's pretty massive. We seem to have a higher diversity of different travel domains now. That's why we see the difference in those two charts.

MC: Other interesting things I picked up from this post that Lily did was what we'll just call refreshes, which is, essentially, these bounce backs. This was noted a few times in this report. The business and finance websites there appeared to have been a significant impact on this algorithm update in terms of biggest winners and losers. But interestingly, there was a significant increase with domain debt.org because it had massive declines in visibility, late 2020, so possibly the December core update. It's one of several sites seeing that pattern, such as parenting.com, livestrong.com, and others.

Again, this is something we saw even in the March 2020 update between core updates, which is sometimes when we do have these drastic impacts, especially on big sites. Sometimes we see them reversed, I guess, as Google's maybe just fine-tuning what they wanted. Again, it's hard for them to actually decide whether it was something that they did in the meantime because I'm sure these big sites that lose big chunks of traffic are all very hard at work trying to work out exactly what it is that they did wrong and how they can fix it or how I can improve things. Then, it comes back, and it, to be honest, may not have been anything that they did.

Lastly, something I thought was really interesting here was a tweet that Lily highlighted from Glenn Gabe asking this to Danny Sullivan from Google. "Hi, Danny. Do you know if there was a refresh of the product reviews update, maybe when the June broad core update rolled out? I'm seeing sites impacted by the product review update with a lot of movement during the June core update, or is this just more from the June core update? Thanks for any information, et cetera."

Danny confirmed that changes you're seeing around the core update are almost certainly related to that. Just to muddy the waters even more, it does look like the big changes we saw in the product review update are somehow connected, maybe not even directly, to the June core update because we've seen the same sites maybe gaining lots of visibility and then suddenly losing it or vice versa. So super, super interesting. That will continue to work its way through the affiliate space as well.

One of the things bubbling away at Google that has been fairly easy to miss, especially with all of the core updates, page experience updates, product review updates, and such that are happening is Google's Shopping Graph. That is because there aren't a huge amount of details available on it yet. It was spoken a little bit about at Google I/O. It was mentioned in Lilly's write-up she did on the June core 2020 update. I thought I would just quickly go over the posts that Google released about it in May, as quite a few of the people I've spoken to hadn't heard of it yet. As usual, I'll link to this post in the show notes at search.withcandour.co.uk.

This post was written on May the 18th by Bill Reedy, who's the president of Commerce and Payments at Google. He says, "We want to help people discover, learn about, and shop for products that they love, whether those products come from big-box retailers, new direct-to-customer brands, or the mum pop shop down the street. We're supporting an open network of retailers and shoppers to help businesses get discovered and give people more options when they're looking to buy. Two concrete steps we've taken to support discoverability for all merchants are eliminating commission fees and making it free for sellers on Google.

"To show you the most relevant shopping information, we must have a deep understanding of the products that appear across Google and in the world around us, from images and videos to online reviews and inventory in local stores. That's why, today, we shed some light on the technology behind our Shopping Graph, our comprehensive, real-time data set about products, inventory, and merchants. The Shopping Graph is a dynamic AI-enhanced model that understands a constantly changing set of products, sellers, brands, reviews, and most importantly, the product information and inventory data we receive from brands and retailers directly, as well as how those attributes relate to one another.

"With people shopping across Google, more than a billion times a day, the Shopping Graph makes those sessions more helpful by connecting people with over 24 billion listings from millions of merchants across the web. It works in real-time, so people can discover and shop for products that are available right now.

"Having a deep understanding of the world's products is just one piece of the puzzle. To help more merchants get discovered, it's important that we support like-minded partners who share in Google's mission to democratise e-commerce. That's why today, at Google IO, we announced that we're expanding our partnership with Shopify, introducing a new simplified process that lets Shopify's 1.7 million merchants feature their products across Google in just a few clicks. This new collaboration with Shopify will enable merchants to become discoverable to high-intense consumers across Google search, shopping, YouTube, Google images, and more.

"As we eliminate barriers like fees and improve our technology, we've seen a 70% increase in the size of our product catalog and an 80% increase in merchants on our platform. But exactly how do these sellers and their products show up across Google?

"Search shopping, image search, and YouTube are popular ways for people to research and discover products. Today, we announced even more ways to get discovered by people shopping every day. We know it's easy to get inspired by just strolling your neighbourhoods, browsing a magazine, or taking note of something online. That's why we're building new, more integrated shopping experiences to meet you where you already are. For instance, one of the most popular ways to take notes of things that they like is by taking a screenshot. But it's not always easy to take action on those screenshots afterwards. Now, when you view any screenshot in Google photos, there will be a suggestion to search the photo with Lens, allowing you to see the search results that can help you find that pair of shoes or wallpaper pattern that caught your eye.

"We also know that shopping isn't always a linear experience. You may open your browser intending to shop, but switch your focus to an email or a news article, or you might not be ready to buy yet. That's why along with other modules in Chrome that help you pick up where you left off. We're introducing a new feature in Chrome that works locally on your device to let you see your Oakland carts when you open a new tab, so when you step away or browse on other sites, you can pick up your shopping where you left off.

"Once you're ready to make a purchase, we want you to make it as easy for you to get the best value for the products that you're buying. Coming soon, we'll let you link your favourite loyalty programs from merchants like Sephora to your Google account to show you the best purchase options across Google, helping brands and their customers foster a stronger, more direct relationship."

That's pretty much the announcement. Again, as I said, I'll link to this in the show notes. This is, I think, just another link in the chain or several links in the chain around, not just the technology Google has been building but positioning themselves in a more competitive stance against Amazon. We've mentioned a couple of times, I think, on this podcast about how one of Google's biggest competitors is Amazon just because a lot of those shopping journeys when you've got this online superstore, Amazon, people are actually skipping Google. They're going straight to Amazon. Part of the reason for this is that there is that breakdown of experience on Google, as you're trying to browse products that are listed on separate websites by separate brands. You've got that change in user journey, change in carts. Obviously, on Amazon, you've got all of that inventory. That's essentially within one user interface within one payment system.

What Google has been working on to try and level the playing field is bringing all the inventory onto Google. That's why they've opened up things like the shopping feeds for free organically so they can get that data. Then, actually, trying to make that one payment, that one user interface, sit together where they've talked about the reduction in the fees, getting Shopify on board and basically trying to make it that you can browse all of the products on Google, buy from Google, and not leave it in a similar way that you can with Amazon.

Then, what we're talking about here with the Shopping Graph is they are flexing all the other technology and data that they've got that Amazon haven't got in terms of how to do this intelligently. So super, super interesting. I think this is going to link in, as Lily said, to these shopping updates. Have a read through that. Look at the examples. Again, there have been a few things we've talked about on the podcast, like with mum and things like this; definitely one we want to be thinking about in the long term.

That's everything I've got time for in this episode. I really hope you've enjoyed it. I'll be back in one week's time, of course, which will be Monday the 28th of June. Until then, I hope you have an absolutely lovely week.